Save some money on your plan renewal by getting value-added tax (VAT) exemption for payments made through the Todoist website. You can get a VAT refund if your personal workspace is on the Todoist Pro plan, or if your team workspace is on the Todoist Business plan.

Warning

About VAT for the Pro plan

For customers based in the USA and Canada, taxes like VAT are calculated and added at checkout.

Apart from making sure pricing is predictable, EU and UK-based customers pay exactly what is shown on the Todoist pricing page. Here's a breakdown:

- No VAT ID: your invoice displays the words

tax included. VAT is included in the total amount, and it’s automatically collected and remitted to the appropriate tax authorities. - With a VAT ID: your invoice displays the words

reverse chargeand no VAT is charged on your invoice; instead, it's handled separately based on your country’s tax regulations.

Note

Add VAT ID when upgrading to the Pro plan

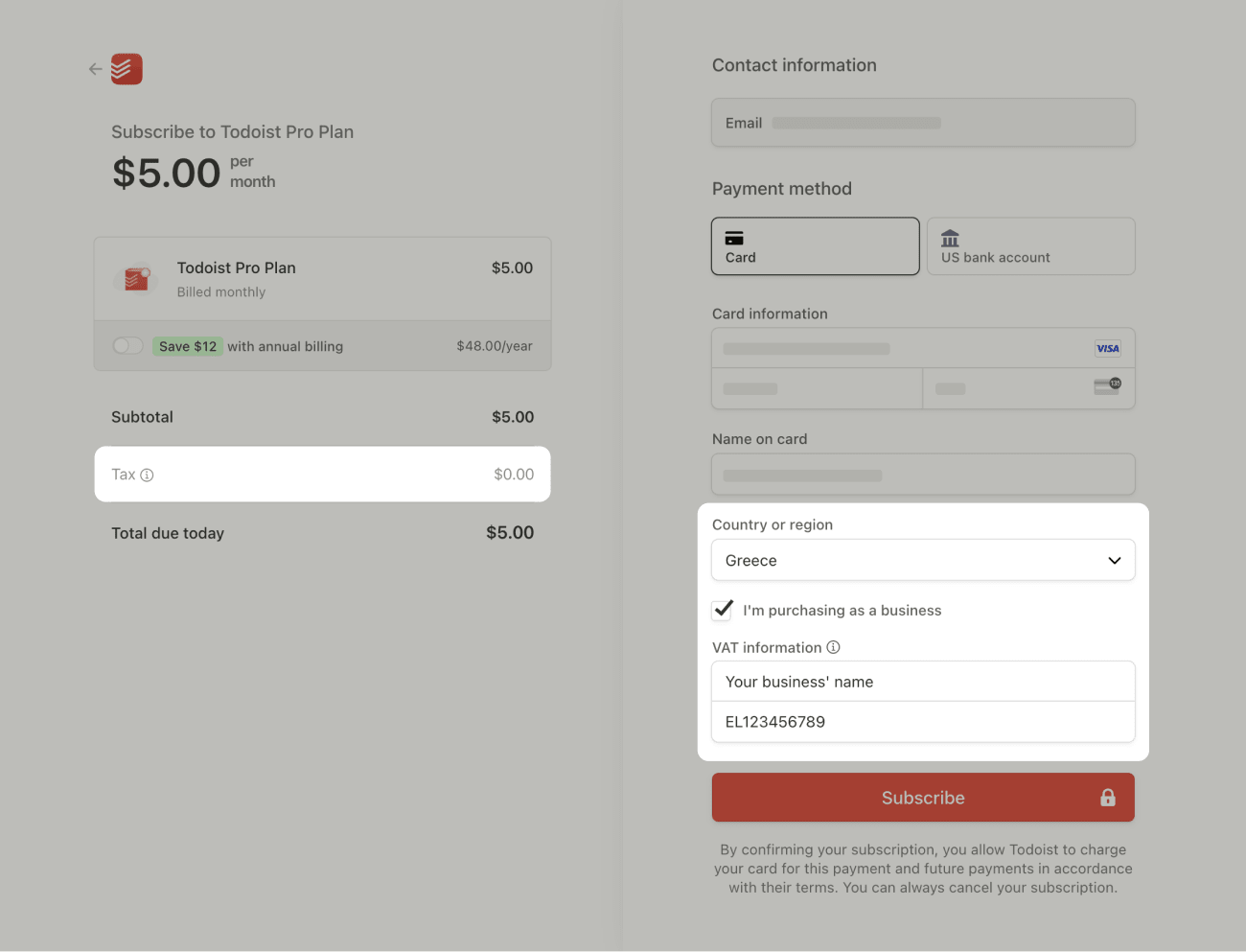

To add the VAT ID directly when upgrading to the Pro plan:

- Log in to your Todoist account at https://todoist.com.

- Click your avatar at the top-left.

- Select Settings.

- Click the Subscription tab.

- Click Upgrade to Pro. You'll see the checkout page.

- Fill in your email address and your payment card details.

- Select I’m purchasing as a business.

- Enter your VAT information.

Add VAT ID for an existing Pro plan

To display your VAT ID in future invoices and qualify for VAT exemption, add the VAT ID and billing address to the Todoist account before the renewal.

- Log in to the Todoist account at https://todoist.com.

- Click your avatar at the top-left.

- Click Settings.

- Click Subscription.

- Click Go to Billing.

- Click Update information under the Billing Information section.

- Add the billing address and VAT ID.

- Click Save to confirm.

About VAT for the Business plan

The Todoist Business plan is tax-exclusive. When a valid VAT ID is added to your team's billing information, the invoice displays the words reverse charge and no VAT will be charged. If no VAT ID is added, the invoice displays the words taxable, and the total amount will include applicable VAT or sales tax.

Add VAT ID when upgrading to the Business plan

Admins alone can edit billing information for Todoist teams. If you're an admin, here's how to add the VAT ID when upgrading to the Business plan:

- Log in to Todoist at https://todoist.com.

- Click your avatar at the top-left.

- Select Settings.

- Scroll down to your team workspace.

- Click Billing.

- Click Upgrade to Business. You’ll see the checkout page.

- Fill in your email address and your card details.

- Select I’m purchasing as a business.

- Enter your VAT information.

Add a VAT ID to an existing Business plan

Admins alone can edit billing information for Todoist teams. If you're an admin, here's how to add the VAT ID to your existing Business plan:

- Log in to the Todoist account at https://todoist.com.

- Click your avatar at the top-left.

- Click Settings.

- Scroll down to your team workspace.

- Click Billing.

- Click Manage Billing.

- Click Update information under the Billing Information section.

- Add the billing address and VAT ID.

- Click Save to confirm.

Get in touch

If you didn't provide a VAT ID prior to being charged, and you require a VAT-exempt invoice and refund, get in touch with us. We – Diane, Summer, Carol, or any of our other teammates – will help you sort this out right away.